Gift Exclusion Amount 2025

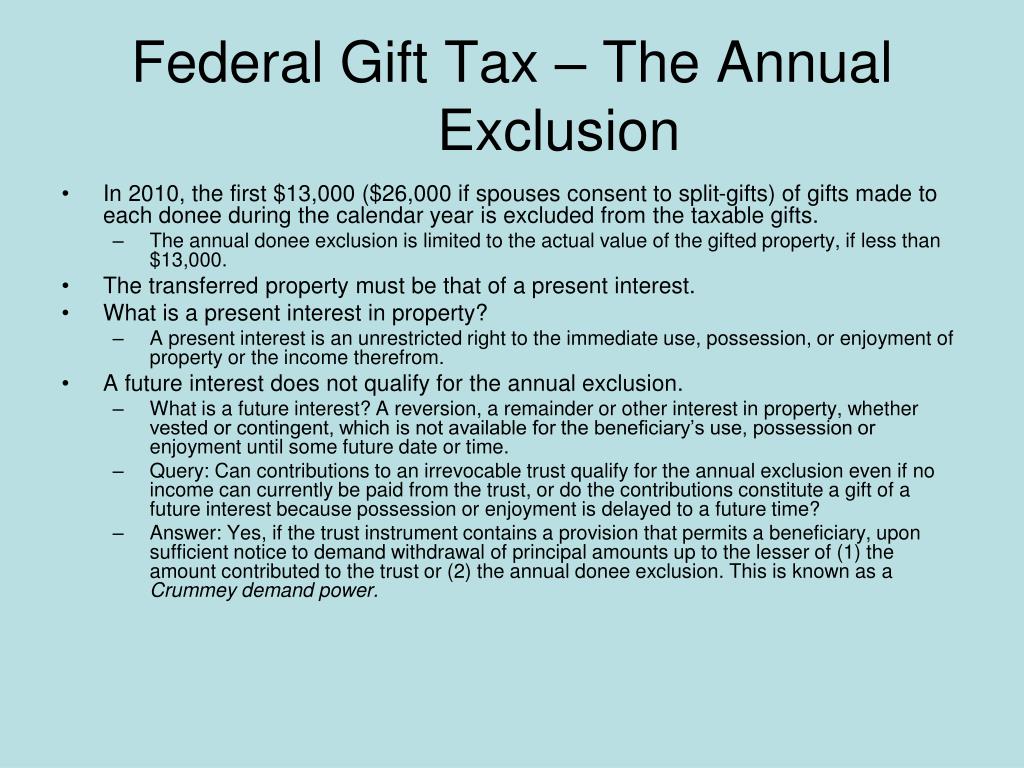

Gift Exclusion Amount 2025. This means you can gift up to $19,000 to each person in your. A popular and extremely effective estate planning tax avoidance strategy involves maximizing the use of the annual exclusion.

For 2024, the current annual gift tax exclusion limit is $18,000. Married couples can effectively double this amount to $38,000 per.

Gift Exclusion Amount 2025 Images References :

Source: 2025and2026schoolcalendar.pages.dev

Source: 2025and2026schoolcalendar.pages.dev

Gift Tax Exemption 2025 Understanding The Lifetime Exclusion And Its, For people who pass away in 2025, the exemption amount will be $13.99 million (it is $13.61 million in 2024).

Source: williambower.pages.dev

Source: williambower.pages.dev

2025 Gift Amount Allowed William Bower, The gift tax annual exclusion (also simply called the annual exclusion) was also changed in 2025 and will be increased to $19,000.

Source: alysvkissee.pages.dev

Source: alysvkissee.pages.dev

Annual Gift Tax Exclusion 2025 Arden Sorcha, The gift tax exclusion amount is the amount an individual may gift to any number of persons annually without incurring a gift tax or reporting obligation.

Source: earthabkatuscha.pages.dev

Source: earthabkatuscha.pages.dev

Gift Amount For 2025 Suzy Elfrieda, Note that these annual limits are per recipient per year so.

Source: helynyraychel.pages.dev

Source: helynyraychel.pages.dev

Irs Gift Amount 2025 Birdie Marilyn, Use the annual gift tax exclusion to its fullest.

Source: emlynnymargie.pages.dev

Source: emlynnymargie.pages.dev

Allowable Gift Amount 2025 Catina Jaynell, Next year, the annual gift tax exclusion is increasing to $19,000.

Source: emlynnymargie.pages.dev

Source: emlynnymargie.pages.dev

Allowable Gift Amount 2025 Catina Jaynell, Only anything above that amount.

Source: jodiymadelena.pages.dev

Source: jodiymadelena.pages.dev

Gift Tax Annual Exclusion 2025 Holly Laureen, In 2025, the annual gift exclusion will rise to $19,000 per recipient —an increase from the $18,000 limit in 2024.

Source: imagetou.com

Source: imagetou.com

Annual Gifting For 2024 Image to u, Note that these annual limits are per recipient per year so.

Source: livyybenetta.pages.dev

Source: livyybenetta.pages.dev

What Is The Gift Amount For 2025 Anna Delilah, The new (2025) federal annual gift.

Category: 2025