Loan Limit Increase 2024

Loan Limit Increase 2024. This is an average 5.3% increase over the 2023 rate which was set at $726,200. New conventional limits increased 5.56% from $726,200 in 2023 to $766,550 in 2024.

The fha announced limits for 2024 for its single family title ii forward and home equity conversion mortgage (hecm) insurance programs, while the fhfa. Most of this increase will come.

Loan Limit Values For 2024.

The projected increase in 2024 is approximately 3.28%, resulting in a new conforming loan limit of $750,000, up from $726,200 in 2023.

While Taking Out A Loan Or Paying Back Debt May Be More Expensive, The High Rates Can Also Put Extra Money In Your Savings.

Conforming loan limits are based on.

The Fhfa Announced Today The Updated Baseline Conforming Loan Limit For 2024 Will Be $766,550, An Increase Of $40,350 From 2023.

Images References :

Source: www.rate.com

Source: www.rate.com

New Conforming Loan Limits Increase for 2024 Guaranteed Rate, Federal reserve officials left interest rates unchanged and signaled that they were wary about how stubborn inflation was proving, paving the way. This calculation determined that the conforming loan limit should rise 5.56% from 2023 levels.

Source: mimutual.com

Source: mimutual.com

Understanding the 2024 FHA Loan Limits What Homebuyers Need to Know, The 2023 loan limit of $726,200 plus 5.56% equals the 2024 limit of. The projected increase in 2024 is approximately 3.28%, resulting in a new conforming loan limit of $750,000, up from $726,200 in 2023.

Source: www.lamacchiarealty.com

Source: www.lamacchiarealty.com

2024 Loan Limits Increase by 40,000 Lamacchia Realty, What do these three lenders offer? While taking out a loan or paying back debt may be more expensive, the high rates can also put extra money in your savings.

Source: burkemortgage.com

Source: burkemortgage.com

2024 Loan Limit Increases for Homebuyers, Expensive markets include the new york, san. Conforming loan limit in 2024.

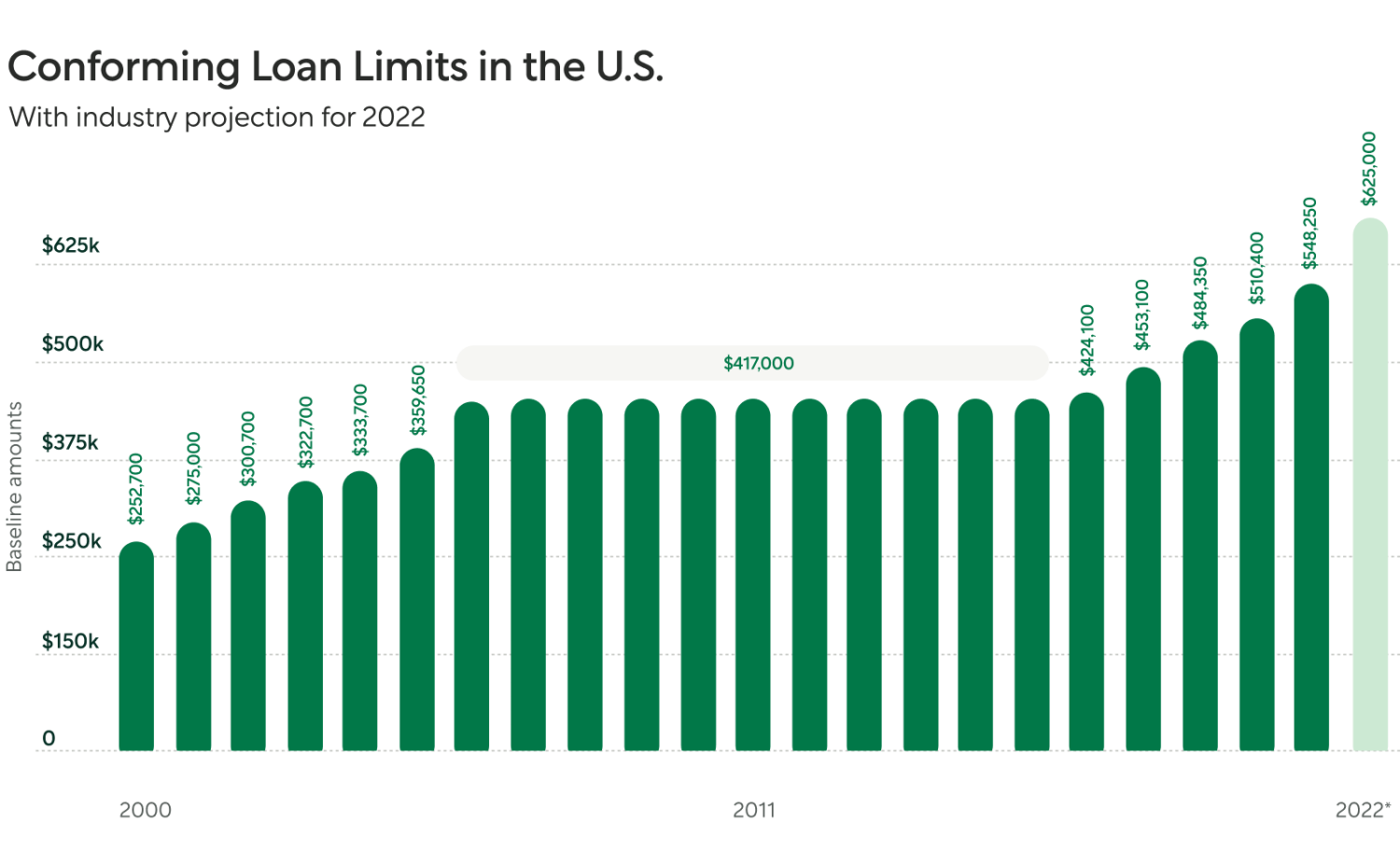

Source: better.com

Source: better.com

Conforming Loan Limits Are Going Up Better Mortgage, The fha announced limits for 2024 for its single family title ii forward and home equity conversion mortgage (hecm) insurance programs, while the fhfa. ( see loan limit history ) average loan.

Source: www.rate.com

Source: www.rate.com

New Conforming Loan Limits Increase for 2024 Guaranteed Rate, This is an average 5.3% increase over the 2023 rate which was set at $726,200. In line with the federal housing finance agency (fhfa) announcement, we’re increasing our maximum baseline.

Source: www.atlanticcoastmortgage.com

Source: www.atlanticcoastmortgage.com

FHFA Announces Increase to Conforming Loan Limits, The federal housing finance agency (fhfa) increased. The conforming loan limits for 2024 have increased and apply to loans delivered to fannie mae in 2024 (even if originated prior to 1/1/2024).

Source: www.rate.com

Source: www.rate.com

New Conforming Loan Limits Increase for 2022 Guaranteed Rate, The baseline conforming loan limit for mortgages backed by. Annual and aggregate loan limits.

Source: www.youtube.com

Source: www.youtube.com

New 2022 Conventional loan limits are now 647,200 Now available, The new loan limit was determined using the following calculation*: Tue, nov 28, 2023, 12:26 pm 3 min read.

Source: pricemortgage.com

Source: pricemortgage.com

2024 Conventional Loan Limits Price Mortgage, In line with the federal housing finance agency (fhfa) announcement, we’re increasing our maximum baseline. The 2023 loan limit of $726,200 plus 5.56% equals the 2024 limit of.

Most Of This Increase Will Come.

For much of the u.s., the divide between conforming loans and jumbo mortgages is $766,550 in 2024.

While Taking Out A Loan Or Paying Back Debt May Be More Expensive, The High Rates Can Also Put Extra Money In Your Savings.

Fhfa, federal housing finance agency.