Tax Refund Schedule 2025 With Dependents Calculator

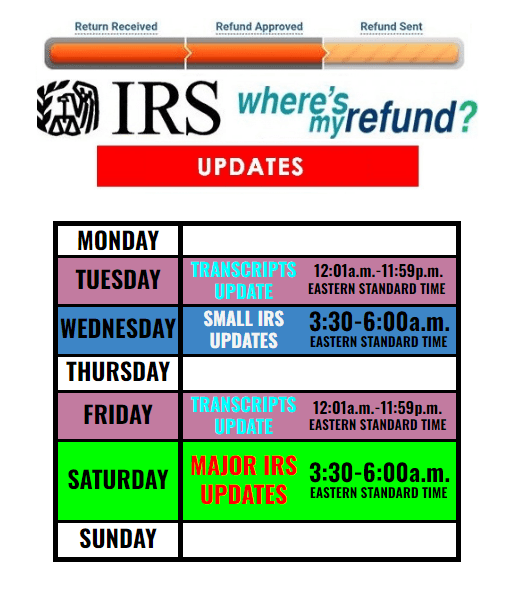

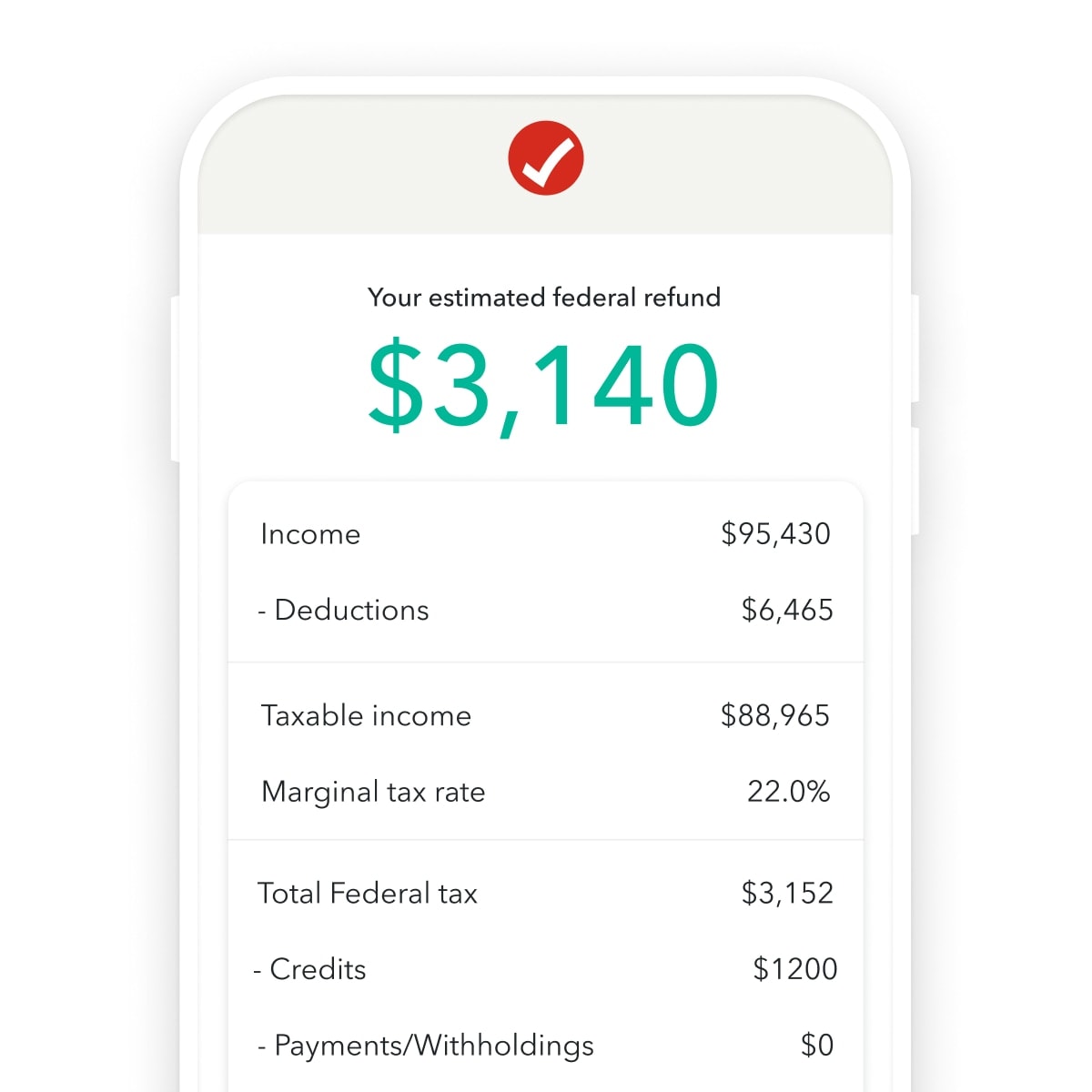

Tax Refund Schedule 2025 With Dependents Calculator. Estimate your tax bill or refund with our free federal income tax calculator. Within 90 working days after manual submission;

Calculate your federal taxes with h&r block’s free income tax calculator tool. Discover all you need to know about personal tax relief 2025.

Tax Refund Schedule 2025 With Dependents Calculator Images References :

Source: karynaseyevette.pages.dev

Source: karynaseyevette.pages.dev

Calculate 2025 Tax Refund Schedule Angele Valene, Within 90 working days after manual submission;

Source: norahiba.pages.dev

Source: norahiba.pages.dev

Calculate Tax Refund 2025 Nora Hiba, Use tax planner 2025 to calculate personal income tax in malaysia.

Source: alinagrace.pages.dev

Source: alinagrace.pages.dev

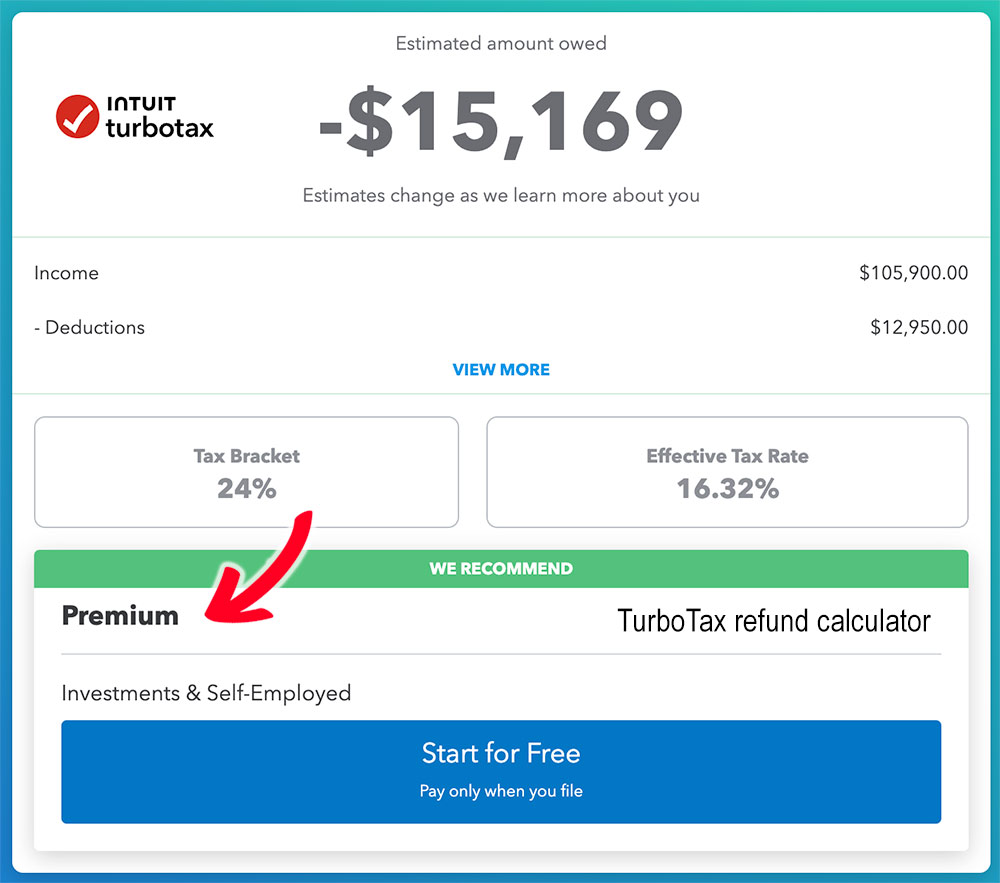

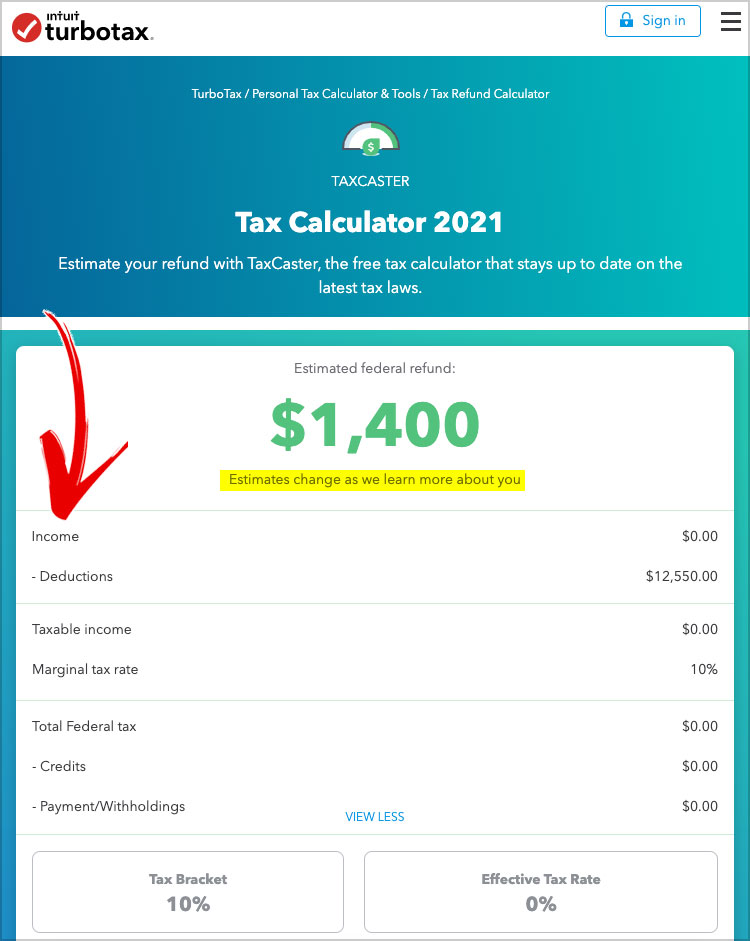

Irs Tax Rebate Calendar Alina Grace, Estimate your tax refund or how much you may owe the irs with taxcaster tax calculator.

Source: stevenhill.pages.dev

Source: stevenhill.pages.dev

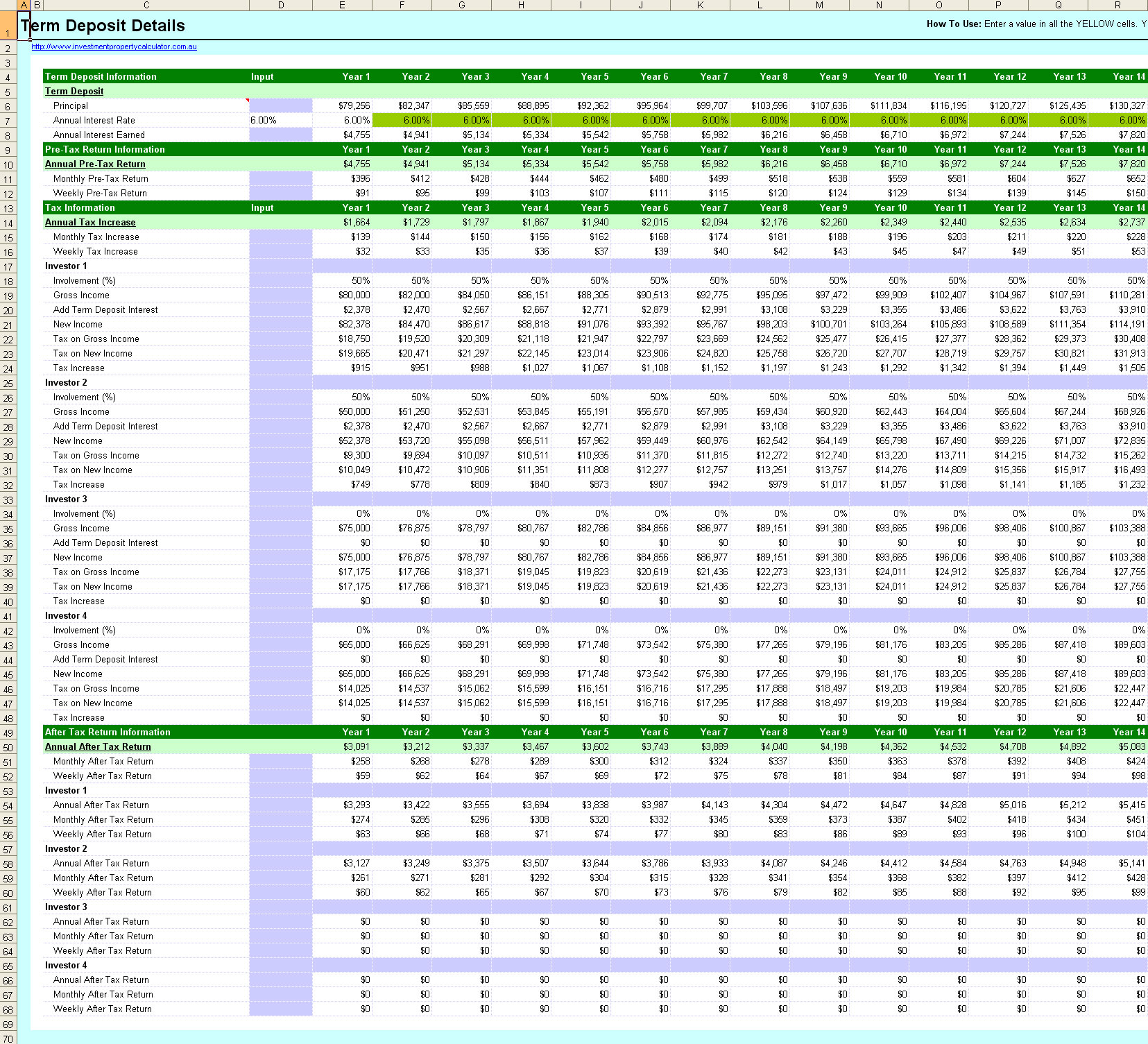

2025 Tax Calculator Estimate Refund In Excel Steven Hill, Get tax refund estimates, find tax brackets, calculate paycheck withholdings, and optimize dependent credits.

Source: marahjkconsolata.pages.dev

Source: marahjkconsolata.pages.dev

2025 Tax Refund Schedule Jorey Christabel, Find out if an individual qualifies as your dependent on your 2025 tax return by answering just a few questions below.

Source: www.msn.com

Source: www.msn.com

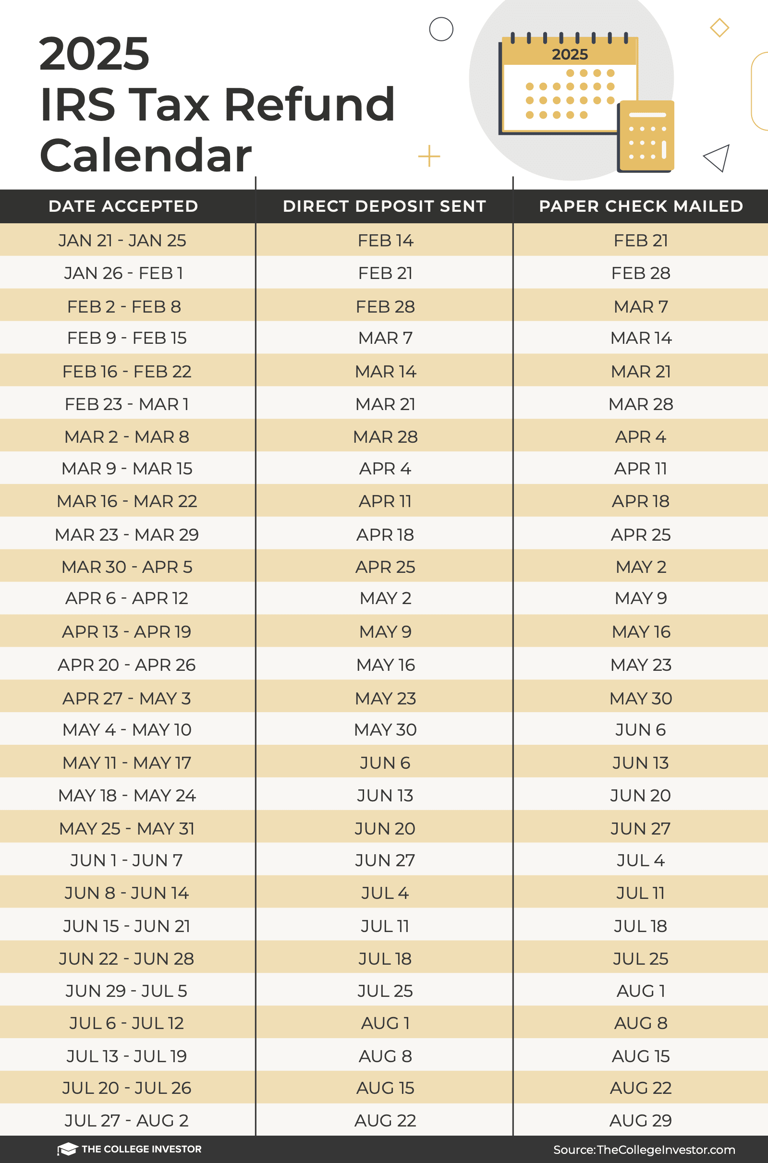

2025 IRS Tax Refund Schedule When To Expect Your Tax Refund, Feel confident with our free tax calculator that's up to date on the latest tax laws.

Source: cindraymaritsa.pages.dev

Source: cindraymaritsa.pages.dev

Irs Tax Calendar Refund 2025 Trudi Hyacinth, Enter the tax relief and you will know your tax amount, tax bracket & tax rate!

Source: terryaseingeberg.pages.dev

Source: terryaseingeberg.pages.dev

2025 Tax Refund Schedule Joete Marena, Use tax planner 2025 to calculate personal income tax in malaysia.

Source: karynaseyevette.pages.dev

Source: karynaseyevette.pages.dev

Calculate 2025 Tax Refund Schedule Angele Valene, The tax refund payment calendar below offers a rough estimate of when to expect a tax refund by direct deposit (approximately 14 days) and paper check by mail (approximately.

Source: mintaaselenette.pages.dev

Source: mintaaselenette.pages.dev

2025 Tax Refund Schedule Nyc Doll Halette, Enter your filing status, income, deductions and credits and we will estimate your total taxes.

Posted in 2025